Certified Financial Planner (CFP) Certification Programme

CFP®, CERTIFIED FINANCIAL PLANNER® and CFP® are certification marks owned outside the United States by Financial Planning Standards Board Ltd. FPAM is the marks licensing authority for the CFP Marks in Malaysia, through agreement with FPSB. UTAR does not certify individuals to use the CFP, CERTIFIED FINANCIAL PLANNER and CFP marks. CFP certification is granted only by FPSB and FPAM to those persons who, in addition to completing an educational requirement offered by this FPAM-approved Education Provider, have met the ethics, experience and examination requirements.

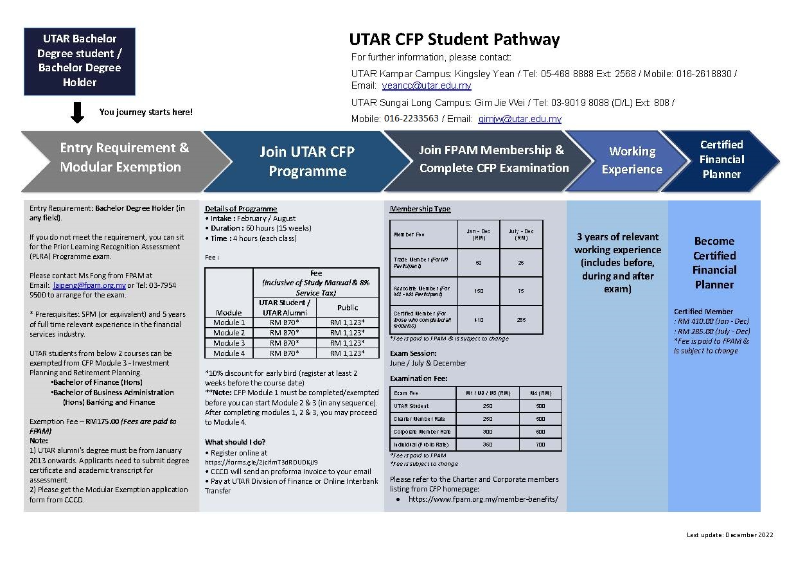

Certification Pathway Options

Interested participants with at least a Bachelor’s degree are required to sit for the entire certification course, which comprises of the following Modules.

Module 1 – Foundation in Financial Planning and Tax Planning (Download Syllabus)

Module 2 – Insurance Planning & Estate Planning (Download Syllabus)

Module 3 – Investment Planning and Retirement Planning (Download Syllabus)

Module 4 – Financial Plan Construction and Professional Responsibilities (Download Syllabus)

The shortest time frame to complete the programme is 9 months.

- For Non degree holder, if you have SPM qualification and at least 5 years of relevant work experience, you can sit for Prior Learning Recognition Assessment (PLRA) – a multiple-choice test. Once passed, you are eligible to apply for CFP programme. Candidates are only allowed to register for the PLRA assessment 2 times and there must be a break of 6 months between the attempts. If you are interested to take the exam, please contact Ms Fong Lai Peng from FPAM, at Email: laipeng@fpam.org.my or Tel: 03-7954 9500 to arrange for the exam.

- UTAR Degree student (Student from Bachelor of Finance and Bachelor of Banking & Finance are exempted from Module 3).

|

NO |

QUALIFICATIONS |

Module 1 |

Module 2 |

|

1 |

Active FIMM member who have passed “CUTE” or “PRS” examination |

√ |

|

|

2 |

Registered Financial Planners (MFPC) |

√ |

√ |

|

3 |

Shariah Registered Financial Planners (MFPC) |

√ |

√ |

|

NO |

QUALIFICATIONS |

|

1 |

Accountants (CA(M), CPA (M), CPA (Aust), AICPA, ACA, ACCA, ICMA and AIA) |

|

2 |

Chartered Secretaries (ICSA & Fellow of MACS) |

|

3 |

Chartered Financial Consultants (ChFC) |

|

4 |

Chartered Financial Analyst (CFA) |

|

5 |

PhD (Business, Accounting or Economics) |

|

6 |

Masters (Business Admin / Finance / Economics / Accounting) from accredited universities |

|

7 |

Islamic Financial Planner (IFP) |

|

Fee |

Jan - Dec |

July - Dec |

|

Trade Member (For M1 Participant) |

RM50 |

RM25 |

|

Associate Member (For M2 - M4 Participant) |

RM150 |

RM75 |

|

Certified Member (For those who completed all modules) |

RM410 |

RM285 |

Fee | M1 / M2 / M3 | M4 |

UTAR Student | RM250 | RM500 |

Charter Member Rate | RM250 | RM500 |

Corporate Member Rate | RM300 | RM600 |

Individual (Public Rate) | RM350 | RM700 |

» If you are working in one of the Charter or Corporate members of FPAM, please get the endorsement on the examination form

- Citizen of Malaysia.

- Applicant must be currently enrolled in full-time undergraduate programme at UTAR.

- Applicant is not on leave of absence/suspension.

- Applicant from needy family (B40) only.

| REGISTER ONLINE |

› February 2024 (Virtual)

› August 2024 (Virtual)

› Testimonials

Wealth Planner Prudential Assurance Malaysia Berhad (PAMB)

The lecturer is very patient and provides a lot of additional information that is related to our life which is very helpful and makes the class more lively and easier to understand.

Leong

Mun Kit

The lecturer uses a very practical approach in this Module 2 to show the applications and ways of approaching insurance and estate planning for the client which is very valuable considering this is a practical course. I do hope that future courses are all like this so that the students can appreciate the importance of book theory and how to apply them to actual real-life scenario.

Mr Kingsley Yean 05-4688 888 (Ext: 2568) /

016-261 8830 yeancc@utar.edu.my